Contents

For example, if a trader places each trade as a limit order to be filled only at the arbitrage price and a price moves due to market activity or new price is quoted by the third party, then the triangular transaction will not be completed. In such a case, the arbitrageur will face a cost to close out the position that is equal to the change in price that eliminated the arbitrage condition. Applying the algorithm to the most traded currencies, we find average profits ranking from 4.5083% to 0.3162% for changing 1 USD for EUR with respect to the direct exchange rate, for different transaction costs, during the period October 2000-April 2012. Our results also suggest that the arbitrage profits increased just after the subprime crisis in summer of 2007 and that they are higher when the market is less liquid. In the foreign exchange market, there are many market participants competing for each arbitrage opportunity; for arbitrage to be profitable, a trader would need to identify and execute each arbitrage opportunity faster than competitors.

How do you identify triangular arbitrage?

A triangular arbitrage opportunity occurs when the exchange rate of a currency does not match the cross-exchange rate. The price discrepancies generally arise from situations when one market is overvalued while another is undervalued.

The third https://forexarticles.net/ in foreign exchange is usually the U.S Dollar, while the other two currencies are determinable against the dollar value. So, for instance, if three currencies are the Great Britain Pound , Euro, and U.S Dollar, then both GBP and Euro will be valued in terms of the U.S Dollar. The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies. Arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from a difference in its price. Fifth, in this final step , the trader converts the third currency back into the base currency. For instance, in the above example, if a trader invests just $100, they would make a profit of just $4.

The Mirage of Triangular Arbitrage in the Spot Foreign Exchange Market

For the Level II exam, I endeavoured not to repeat the mistakes I made. Based on the Pareto 80/20 principle, I learnt to extract the most essential bits from the curriculum enough to give me that 80% result to pass. Being a visual learner, I took notes and summaries in pictorial form. Instead of reserving huge segments of time to study, I carved out pockets of time to learn and practise – accommodating to my full-time job.

Second, the decision making processes, the available https://bigbostrade.com/ strategies and the rules governing the interactions among agents retain a remarkable simplicity. This reduces the computational effort required to build and simulate the dynamics of the model and facilitates the understanding and interpretation of its outcomes. Third, the Arbitrager Model does not achieve its goal by directly modelling cross-currency correlations.

As soon as one of these processes exceeds the unit, the arbitrager submits market orders to exploit the current opportunity . Contrary to limit orders, market orders trigger an immediate transaction between the arbitrager and the market maker providing the best quote on the opposite side of the LOB. This implies that transactions involving the arbitrager are always settled at the bid or ask quote offered by the matched market maker, which are by the definition the current best bid or ask quote of the LOB.

The Time-Varying Systematic Risk of Carry Trade Strategies

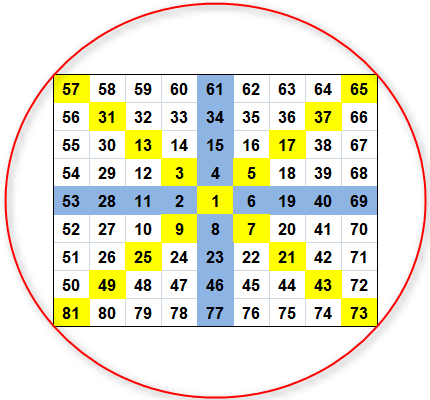

Triangular arbitrage refers to the discrepancies in the cross-exchange rate of currencies. It occurs when there is a sudden change in the exchange rates of currencies that do not match the cross-exchange rate, and the difference occurs. The cross-exchange rate is a method of valuing two currencies against a third currency. Currency pairs are two currencies with exchange rates coupled for trading in the foreign exchange market. Triangular arbitrage is a form of low-risk profit-making by currency traders that takes advantage of exchange rate discrepancies through algorithmic trades. Arbitrage is already a rare profit opportunity, and triangular arbitrage is rare.

Is arbitrage really profitable?

While crypto arbitrage can be a profitable trading strategy for advanced traders and under the right circumstances, the fact remains that arbitrage trading is very difficult to do for most traders. There are simply too many moving parts, too little room for error, and too few profits.

For instance, the EUR/USD and EUR/JPY markets have the same state in ≈ 57% of the experiment duration, see Fig 6. Movements of FX rate pairs become correlated, revealing cross-correlation functions ρi,j(ω) whose shapes qualitatively mimic those found in real trading data. The sign and stabilization levels of these functions are consistent with the sign and size of the probabilities imbalances, suggesting that these two results are two faces of the same coin. Such wide interest across different fields of research in application of detrended cross-correlation analysis to nonlinear time series studies serves as an additional strong motivation for elucidating such analysis in terms of its potential and limitations. Arbitrage trading is an opportunity in financial markets when similar assets can be purchased and sold simultaneously at different prices for profit.

3 Detrended cross-correlation q-coefficient in the Forex market

As we have already mentioned above, in the Forex market all currency rates are connected through mutual exchange rate mechanism. This time lag could be regarded as an estimate for the time duration of window of opportunity to execute an arbitrage opportunity. Research examining high-frequency exchange rate data has found that mispricings do occur in the foreign exchange market such that executable triangular arbitrage opportunities appear possible.

Fluctuations of high-frequency exchange rates of eight major world currencies over 2010–2018 period are used to study cross-correlations. The study is motivated by fundamental questions in complex systems’ response to significant environmental changes and by potential applications in investment strategies, including detecting triangular arbitrage opportunities. Dominant multiscale cross-correlations between the exchange rates are found to typically occur at smaller fluctuation levels. However, hierarchical organization of ties expressed in terms of dendrograms, with a novel application of the multiscale cross-correlation coefficient, is more pronounced at large fluctuations. The cross-correlations are quantified to be stronger on average between those exchange rate pairs that are bound within triangular relations. Some pairs from outside triangular relations are, however, identified to be exceptionally strongly correlated as compared to the average strength of triangular correlations.

This formula helps determine the value of two currencies against per unit of the third currency. For instance, if there is an overvaluation of €/£, then the value of the euro (€) increases against the third currency or base currency, the U.S Dollar. However, like all other forms of trading in assets, triangular arbitration also comes with certain risks. For instance, hidden transaction costs might eat into the profits or reduce margins for the traders. Additionally, traders may lose money or be unable to lock in profits due to the difference in seconds. As said above, the opportunities to make a profit from a triangular arbitrage are very rare and exist for just seconds.

- Arbitrage is considered as a lower risk trading method as compared to the traditional trading where the timing of the buy/sell is crucial.

- Calculating triangular arbitrage in a centralised finance context using poloniex API.

- Such influence should be particularly strong when comparing exchange rates of currencies with a common, the so-called base currency.

- With the exciting announcement of Alpaca’s coin pair trading, we introduce a triangular arbitrage strategy using BTC/USD, ETH/USD, and the new BTC/ETH coin pair to attempt to profit from potential differences between price conversions.

Because an individual could never get their transaction costs as low as a large bank, they couldn’t profitably take advantage of the small arbitrages which exist. The lower your transaction costs, the smaller the arbitrage you can profitably take advantage of. If you don’t sell the currency forward, then you are engaging in uncovered interest arbitrage, meaning you are attempting to exploit an interest rate differential without using forward/futures contracts.

JavaScript Bot that does decentralized cryptocurrency exchange triangular arbitrage is a tool that allows users to take advantage of price differences between different cryptocurrency exchanges. Reports the average GA arbitrage profit with respect to direct exchange rate and the average number of exchange rates, as well as their standard deviation and median, for the entire sample and for two subsamples . For the currency a as an average out of cumulative log-returns for all exchange rates that have a as a base currency. In the following sections, we’ll look at historical data to analyze a type of market neutral trade called a pairs trade.

So, programmers will try to fine-tune algorithms to identify opportunities and act on them before they disappear. Opportunities for this method of forex trading are very rare, and traders who manage to capitalise on it usually have sophisticated computer programs to automate the process. Thereby, the Japanese trader will earn profits worthJPY 24,117.647through triangular arbitrage on an initial investment worth JPY 50,000. Thus, trader detects a rise in the value of the Japanese Yen against a devaluing Euro by a fraction. Hence, the Japanese trader converts a large sum, i.e., JPY 50,000, to multiply his profits by this slight difference.

In our strategy, we follow the methodology developed in Reference for automatic selection. The dominant contribution is due to small- and medium-size fluctuations . Hence, by choosing a range of values in q we may filter out correlation coefficient for either small or large fluctuations. Both time series are synchronized in time and have the same number N of data points. As expected, the implied cross-rate bid should be less than the offer rate. There are risks unique to automated trading algorithms that you should know about and plan for.

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Structured Query Language is a programming language used to interact with a database…. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

In this https://forex-world.net/, we amplified 12 new AGH cDNAs in species belonging to five different families of the infra-order Ligiamorpha of terrestrial isopods. An insulin-like growth factor motif was also identified in Armadillidium AGH sequences. The phylogenetic relationships of AGH sequences allowed one to distinguish two main clades, corresponding to members of the Armadillidiidae and the Porcellionidae families which are congruent with the narrow specificity of AG heterospecific grafting. An in-depth understanding of the regulation of AGH expression would help deciphering the interaction between Wolbachia, widespread feminizing endosymbiotic bacteria in isopods, and the sex differentiation of their hosts. Future works shall also consider established (e.g., AR family models) and novel tools to exploit further properties of FX rates co-movements.

Bid/ask (buy/sell) quotes give the spread, that is a difference in prices at which one can buy/sell a currency. The spread is dependent on the liquidity as well as on some other factors. In general, one observes significant variations of considered currency indexes over the period of 8 years. Worth noting in this timeline are Swiss National Bank interventions in 2011 and in 2015 as well as the Brexit referendum in 2016.

It is a rate published by the New York federal reserve based upon secured overnight transactions in the repo… Finally, the trader can sell these euros to Citibank for $1,014,533 (€1,121,651 x $0.9045). When he did so, arbitrage arose when he made a profit instead of converting rupiah to euros directly. By buying and selling imbalanced currencies, you can in theory make a risk-free profit, but if you’re not quick enough you can lose out. The law of one price is the theory that an economic good or asset will have the same price in different markets, given certain assumptions. Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency.

C Extra Trading Co.,Ltd.

C Extra Trading Co.,Ltd.

Join the conversation